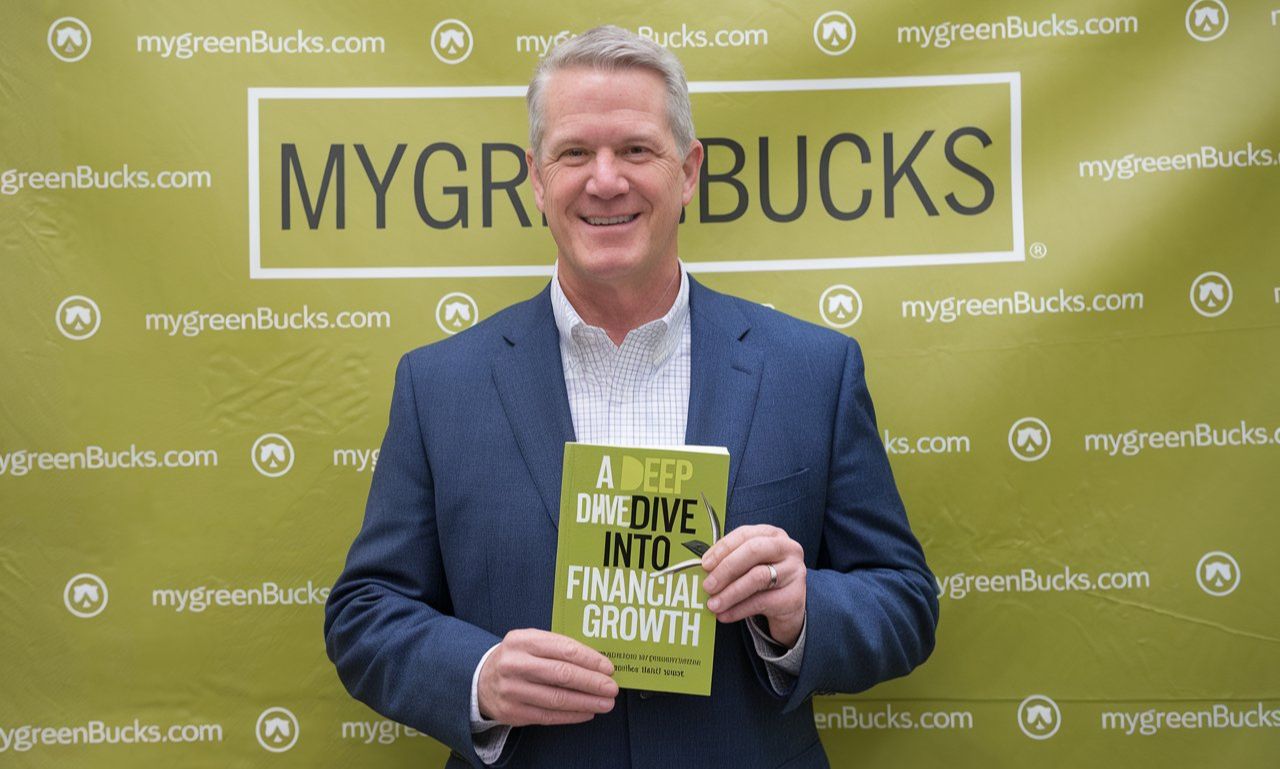

In the world of personal finance, finding reliable resources for wealth-building strategies is essential. One name that stands out is mygreenbucks kenneth jones. Known for offering insightful financial advice, this platform provides individuals with the tools necessary to achieve financial stability. Whether through investment tips, passive income opportunities, or budgeting strategies, mygreenbucks kenneth jones has become a trusted source for many looking to take control of their finances.

Understanding the Philosophy Behind mygreenbucks kenneth jones

Financial success is not achieved overnight. The core philosophy behind mygreenbucks kenneth jones revolves around consistent effort, smart decision-making, and leveraging financial opportunities. The platform emphasizes financial literacy, ensuring that individuals understand the principles behind saving, investing, and growing wealth. By adopting these principles, individuals can work toward a secure financial future while minimizing risks and maximizing potential gains.

Key Strategies for Wealth Accumulation

Achieving financial growth requires a well-structured approach. mygreenbucks kenneth jones offers several key strategies that help individuals build and sustain wealth over time.

Budgeting and Expense Management

One of the fundamental principles of financial success is budgeting. mygreenbucks kenneth jones encourages individuals to track their income and expenses meticulously. By understanding where money is spent, adjustments can be made to allocate funds more efficiently. This approach ensures that financial goals remain attainable while unnecessary expenditures are minimized.

Investing for Long-Term Growth

Investing plays a crucial role in wealth accumulation. mygreenbucks kenneth highlights the importance of diversification, ensuring that investments are spread across different asset classes. Stocks, bonds, real estate, and mutual funds are among the recommended options. By taking a long-term approach, individuals can benefit from compound growth and market appreciation.

Creating Multiple Income Streams

Relying on a single source of income can be risky. To mitigate financial uncertainty, mygreenbucks kenneth jones advocates for multiple income streams. Side businesses, dividend-paying stocks, rental properties, and digital products are just a few options that can generate passive income. These additional revenue sources contribute to long-term financial security.

The Role of Passive Income in Financial Stability

Passive income is a critical component of financial independence. mygreenbucks kenneth jones provides insights into various passive income strategies that allow individuals to earn money with minimal ongoing effort. Rental income, dividend investments, affiliate marketing, and automated business models are some of the most effective ways to generate recurring revenue. By implementing these strategies, individuals can reduce financial stress and create sustainable wealth.

Overcoming Financial Challenges with mygreenbucks kenneth jones

Achieving financial success is not without obstacles. Economic downturns, unexpected expenses, and market fluctuations can pose challenges. However, mygreenbucks kenneth equips individuals with the knowledge and tools needed to navigate these difficulties. Emergency funds, diversified investments, and risk management strategies are emphasized to ensure financial resilience.

The Importance of Financial Education

Financial literacy is a powerful tool. mygreenbucks kenneth stresses the need for continuous learning and staying informed about market trends. Understanding concepts like inflation, interest rates, and investment risks allows individuals to make sound financial decisions. By educating themselves, individuals can build confidence and make informed choices that support their long-term financial goals.

Conclusion: Taking Control of Financial Futures

The journey to financial freedom begins with the right mindset and resources. mygreenbucks kenneth jones provides individuals with the strategies, tools, and insights necessary for long-term success. By implementing effective budgeting, investing wisely, and creating multiple income streams, financial stability becomes an achievable goal. Through education and strategic planning, anyone can take control of their financial future and build lasting wealth.